Offshore Company Formation Made Simple: Expert Tips for Success

Wiki Article

Whatever You Need to Know Concerning Offshore Business Development

Navigating the complexities of offshore firm formation can be an overwhelming job for several individuals and businesses wanting to increase their operations worldwide. The allure of tax obligation advantages, asset defense, and increased personal privacy typically draws passion towards developing offshore entities. Nevertheless, the detailed internet of lawful demands, regulative structures, and economic considerations can position significant obstacles. Recognizing the subtleties of offshore firm formation is crucial for making notified decisions in a globalized company landscape. By untangling the layers of advantages, obstacles, steps, tax obligation ramifications, and compliance commitments associated with offshore company formation, one can gain a comprehensive understanding into this multifaceted topic.Benefits of Offshore Company Formation

The benefits of developing an overseas business are complex and can considerably profit businesses and individuals looking for calculated monetary preparation. One vital advantage is the capacity for tax obligation optimization. Offshore business are frequently based on beneficial tax obligation policies, permitting minimized tax obligation obligations and boosted revenues. Additionally, establishing up an offshore company can give property protection by dividing personal assets from business liabilities. This separation can guard personal wealth in case of legal disputes or financial obstacles within the organization.

Additionally, offshore business can promote international service procedures by supplying access to international markets, expanding income streams, and boosting company trustworthiness on an international scale. By establishing an overseas presence, services can take advantage of brand-new possibilities for growth and development past their residential boundaries.

Common Challenges Faced

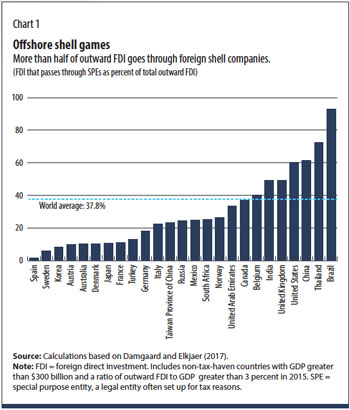

In spite of the numerous advantages associated with overseas business formation, organizations and people frequently experience typical obstacles that can influence their operations and decision-making processes. Navigating differing lawful frameworks, tax obligation regulations, and reporting criteria across various territories can be taxing and overwhelming.One more typical obstacle is the danger of reputational damage. Offshore business are occasionally watched with uncertainty because of problems about tax obligation evasion, money laundering, and absence of transparency. Handling and reducing these understandings can be challenging, specifically in an increasingly scrutinized international service atmosphere.

Moreover, establishing and maintaining effective interaction and oversight with offshore procedures can be challenging because of geographical distances, cultural distinctions, and time zone differences. This can bring about misconceptions, hold-ups in decision-making, and problems in checking the efficiency of overseas entities. Getting over these obstacles needs cautious planning, thorough threat administration, and a thorough understanding of the governing landscape in overseas jurisdictions.

Actions to Form an Offshore Firm

Establishing an offshore company involves a series of tactical and lawfully compliant actions to ensure a successful and smooth development procedure. The very first step is to select the offshore territory that best matches your business demands. Aspects to take into consideration consist of tax regulations, political security, and online reputation. Next off, you require to choose an ideal business name and ensure it complies with the regulations of the chosen territory. Following this, you will certainly require to involve a registered representative who will aid in the unification procedure. The 4th step involves preparing the needed documents, which usually includes short articles of consolidation, shareholder details, and supervisor information. When the paperwork is all set, it requires to read what he said be sent to the pertinent authorities in addition to the requisite fees (offshore company formation). After the authorities authorize the application and all costs are paid, the business will be officially registered. It is necessary to abide with recurring coverage and compliance demands to preserve the great standing of the overseas company.Tax Ramifications and Considerations

Purposefully navigating tax obligation effects is critical when developing an offshore company. Among the primary factors people or organizations select offshore firm development is to take advantage of tax benefits. However, it is important to comply and understand with both the tax obligation laws of the offshore jurisdiction and those of the home nation to make certain lawful tax obligation optimization.Offshore business are frequently based on favorable tax programs, such as low or no business tax obligation prices, exceptions on specific kinds of revenue, or tax deferral alternatives. While these benefits can cause significant financial savings, it is very important to structure the overseas firm in a manner that lines up with tax obligation legislations to stay clear of possible lawful problems.

In addition, it is vital to consider the ramifications of Controlled Foreign Corporation (CFC) policies, Transfer Prices regulations, and other global tax laws that may affect the tax obligation therapy of an overseas company. Consulting from tax experts or experts with proficiency in overseas taxes can assist navigate these complexities and ensure compliance with relevant tax obligation policies.

Handling Compliance and Regulations

Navigating through the intricate internet of compliance requirements and laws is vital for guaranteeing the smooth procedure of an offshore business, especially taking into account tax obligation implications and considerations. Offshore jurisdictions commonly have details legislations controling the development and operation of companies to avoid money laundering, tax evasion, and other illegal activities. It is critical for business to stay abreast of these policies to stay clear of significant fines, lawful concerns, or even the possibility of being closed down.To manage compliance successfully, offshore companies should designate educated professionals that recognize the international criteria and local regulations. These experts can help in establishing appropriate governance structures, maintaining accurate financial records, and submitting called for records to regulatory authorities. Routine audits and testimonials should be performed to guarantee ongoing compliance with all relevant regulations and guidelines.

Additionally, remaining notified regarding modifications in legislation and adapting methods as necessary is important for long-term success. Failing to follow Click This Link guidelines can stain the reputation of the business and result in serious repercussions, highlighting the importance of focusing on compliance within the offshore firm's operational framework.

Final Thought

Finally, overseas firm formation supplies various advantages, however also comes with challenges such as tax obligation ramifications and compliance demands - offshore company formation. By following the needed steps and thinking about all elements of forming an overseas company, services can make use of global possibilities while managing dangers effectively. It is essential to stay educated regarding guidelines and remain compliant to ensure the success and long life of the overseas service ventureBy unraveling the layers of benefits, site link difficulties, actions, tax obligation effects, and compliance commitments associated with overseas firm development, one can get a detailed insight into this complex topic.

Offshore business are often subject to positive tax laws, permitting for minimized tax responsibilities and increased revenues. One of the key factors individuals or services decide for overseas business development is to benefit from tax obligation advantages. Offshore territories usually have specific regulations controling the formation and operation of business to avoid cash laundering, tax evasion, and other immoral activities.In verdict, offshore business development supplies different advantages, but also comes with obstacles such as tax ramifications and compliance demands.

Report this wiki page